How to Price a Business for Sale: A Comprehensive Guide

Pricing a business for sale is one of the most critical steps in the process of selling. A well-priced business attracts buyers, maximizes your return on investment, and ensures a smooth transaction. On the other hand, pricing too high or too low can result in delays, missed opportunities, or even the failure of the sale. So, how do you determine the right price for your business? Let’s walk through the key steps involved in pricing your business for sale.

1. Understand the Business Valuation Process

The first step in pricing your business for sale is understanding how its value is determined. Business valuation is an art as much as it is a science, as it relies on a combination of financial analysis, industry trends, and market conditions. There are several methods used to value a business:

- Asset-Based Valuation: This method looks at the company’s tangible and intangible assets, including physical assets like real estate, inventory, and equipment, as well as intangible assets like trademarks, patents, and brand reputation. The value is calculated by subtracting liabilities from the total value of assets.

- Income-Based Valuation: This method focuses on the business’s ability to generate future income. It typically uses financial metrics like profit, revenue, and cash flow to estimate the business’s earning potential. The most common approach here is the capitalization of earnings method, where expected future profits are capitalized into a present-day value.

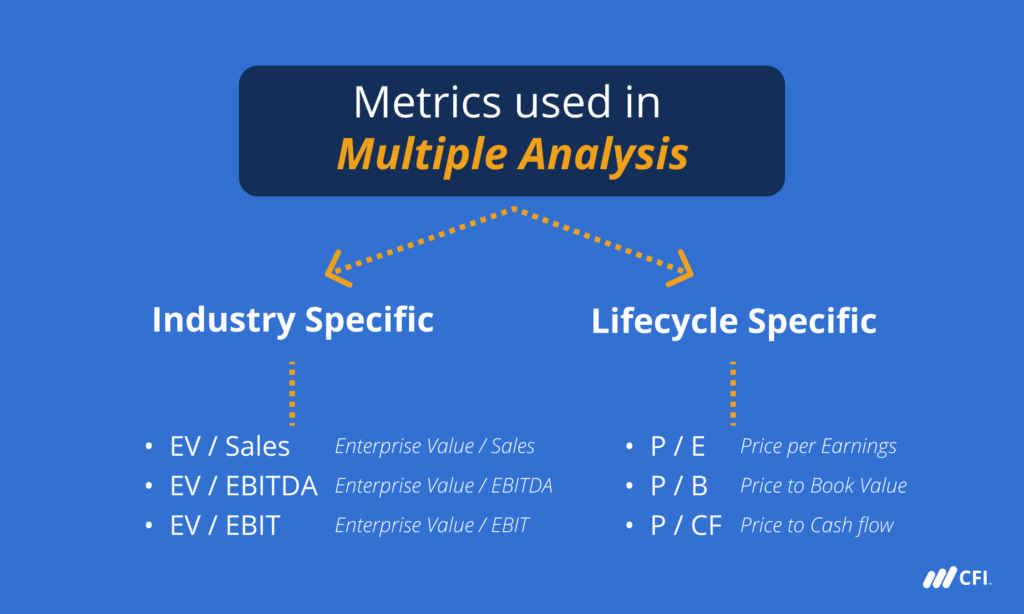

- Market-Based Valuation: This method compares the business to similar companies that have recently been sold or are publicly traded. It uses financial ratios like price-to-earnings (P/E) or price-to-sales (P/S) to assess the business’s value in relation to others in the same industry.

2. Review Financial Records and Statements

To establish an accurate price, you’ll need to gather and review the financial records of your business. Buyers will want to see the financial health of the company before making an offer. You should be ready with the following documents:

- Profit and Loss Statements: These documents show your business’s income and expenses over a specific period, typically for the past 3–5 years. They provide insight into profitability and revenue trends.

- Balance Sheets: A balance sheet provides a snapshot of the company’s assets, liabilities, and equity at a given point in time, giving potential buyers a clear understanding of your business’s financial position.

- Cash Flow Statements: Cash flow is critical for any business. A consistent cash flow assures buyers that the business generates enough money to sustain operations and service debt.

- Tax Returns: Buyers may ask for your business tax returns for the last 3–5 years. This verifies your profitability and shows that you are compliant with tax laws.

3. Factor in Intangible Assets

In addition to the hard assets and financial data, intangible assets can also play a significant role in determining the value of your business. Intangible assets include:

- Brand Recognition: A well-established brand, loyal customer base, and strong online presence can add significant value to your business.

- Customer Contracts and Relationships: Long-term contracts, ongoing customer relationships, and repeat business can be valuable to a buyer, as they represent predictable future revenue streams.

- Proprietary Technology or Intellectual Property: Patents, proprietary software, and trademarks can contribute significantly to the valuation of your business.

- Employee Skills and Expertise: A talented and loyal workforce is often considered an asset, particularly in industries where specialized knowledge or craftsmanship is essential.

4. Consider Market Conditions and Industry Trends

The market conditions and industry trends play a critical role in determining your business’s value. If your business operates in a growing industry with high demand, it could be worth more than one in a stagnating or declining market.

Consider these factors:

- Industry Performance: A booming industry will likely support a higher price for your business. For instance, tech startups, renewable energy companies, or healthcare businesses are currently in high demand, so they might attract higher valuations.

- Economic Climate: Broader economic conditions, such as interest rates, inflation, and consumer spending, can influence a business’s valuation. In times of economic uncertainty, business valuations may be lower as buyers may be more cautious.

- Market Comparisons: Research businesses that are similar to yours in size, location, and industry that have recently sold. This provides a benchmark for pricing your business.

5. Use Multiple Valuation Methods

It’s always a good idea to use a combination of valuation methods to arrive at a reasonable price for your business. For instance, you can start by calculating the value based on your financial records and asset value, then use a market-based approach to compare similar businesses in your industry.

Using multiple methods will give you a more comprehensive understanding of your business’s worth and help you set a price that is competitive and attractive to buyers.

6. Consider Buyer’s Perspective and Negotiation Leverage

While setting a price for your business, consider the buyer’s perspective. Buyers are typically looking for a good return on investment (ROI), and they may try to negotiate a lower price. Some key factors that buyers will look at when assessing value include:

- Risk Factors: Businesses with high-risk factors (e.g., reliance on a single customer or limited market share) may be priced lower to account for potential future uncertainty.

- Growth Potential: Buyers will be more willing to pay a premium for a business if they see significant growth potential in the near future. If you can demonstrate opportunities for scaling or expanding the business, you can potentially command a higher price.

- Synergies: If your business complements a buyer’s existing operations, they may be willing to pay more for the synergies it provides. For example, a larger company may value your business higher if it aligns with their current portfolio and will allow them to expand their market share.

7. Get Professional Help

Valuing and pricing a business for sale is a complex task, and there is no one-size-fits-all approach. It’s often wise to seek professional help to ensure you get the right price. You might want to consider the following experts:

- Business Valuators: These professionals specialize in determining the value of businesses. They can provide an unbiased, accurate valuation using various methods.

- Accountants: An accountant with experience in business sales can help you organize your financial statements and ensure you’re presenting your business in the best possible light.

- Business Brokers: Business brokers can help you with the pricing process, as well as market your business and connect you with potential buyers.

- Mergers and Acquisitions (M&A) Advisors: If you’re selling a larger business, an M&A advisor can assist in determining an appropriate valuation and guide you through the entire sale process.

8. Set a Realistic Price

It’s tempting to price your business high, especially if you’ve invested a lot of time and effort into it. However, overpricing can turn potential buyers away, leading to a longer sales process or the business not selling at all. On the other hand, pricing it too low may mean you’re leaving money on the table.

Set a realistic price based on the valuation methods you’ve used, taking into account both the tangible and intangible assets of your business. Keep in mind that pricing too aggressively can also hurt the business’s marketability, while a reasonable price will help you attract more potential buyers and create a quicker sale.

9. Prepare for Negotiation

Once you’ve set the price, be prepared for negotiations. Buyers will often attempt to lower the price or ask for other favorable terms, so be ready to justify your asking price with data and reasoning. You may want to set a minimum price you’re willing to accept, but be flexible during the negotiation process.

Conclusion

Pricing your business for sale is an intricate process that requires careful analysis and consideration of many factors. By following the steps outlined above — from understanding valuation methods and reviewing financial statements to seeking professional help and setting a realistic price — you’ll be in a better position to price your business competitively and attract serious buyers. The right price not only ensures a successful sale but also allows you to maximize the return on the years of hard work you’ve put into building your business.

Post Comment