NVIDIA Stock Price: A Comprehensive Analysis

NVIDIA Corporation (NASDAQ: NVDA) has been one of the most prominent and high-performing stocks in the technology sector. Known for its cutting-edge graphics processing units (GPUs), artificial intelligence (AI) advancements, and data center solutions, NVIDIA has consistently attracted the attention of investors and analysts alike. In this article, we take an in-depth look at NVIDIA’s stock price, its historical performance, key factors influencing its valuation, and future outlook.

Historical Performance of NVIDIA Stock

NVIDIA’s stock has experienced substantial growth over the past decade, driven by innovations in gaming, AI, and data center technologies. Some key milestones in its stock performance include:

- Early Growth (2010-2015): NVIDIA transitioned from a gaming-centric company to a leader in GPU computing, leading to steady stock appreciation.

- AI and Data Center Boom (2016-2019): The adoption of AI and deep learning contributed to a significant surge in NVIDIA’s stock price, with major companies leveraging its GPUs for AI training and cloud computing.

- Pandemic Surge (2020-2021): With the rise of remote work, gaming, and crypto mining, NVIDIA’s stock saw record highs as demand for GPUs soared.

- Market Corrections and Rebound (2022-2023): Economic concerns and supply chain disruptions led to volatility, but strong AI advancements and continued demand helped the stock recover.

Key Factors Influencing NVIDIA Stock Price

Several factors contribute to NVIDIA’s stock performance, including:

- Product Innovations: NVIDIA continuously develops new technologies, such as its RTX GPU series, AI-focused Tensor Cores, and high-performance computing solutions, which drive investor confidence.

- Earnings Reports: Quarterly financial reports impact stock valuation, as revenue growth, profitability, and guidance influence investor sentiment.

- AI and Data Center Growth: The increasing adoption of AI-powered applications, cloud computing, and high-performance computing solutions has boosted NVIDIA’s market position.

- Gaming Industry Trends: As a leader in gaming GPUs, NVIDIA benefits from strong gaming hardware sales, esports expansion, and next-gen gaming trends.

- Cryptocurrency Mining: The demand for GPUs in crypto mining has historically impacted NVIDIA’s sales, but regulatory changes and market fluctuations create unpredictability.

- Macroeconomic Conditions: Inflation, interest rates, supply chain issues, and global semiconductor demand all play a role in stock price movements.

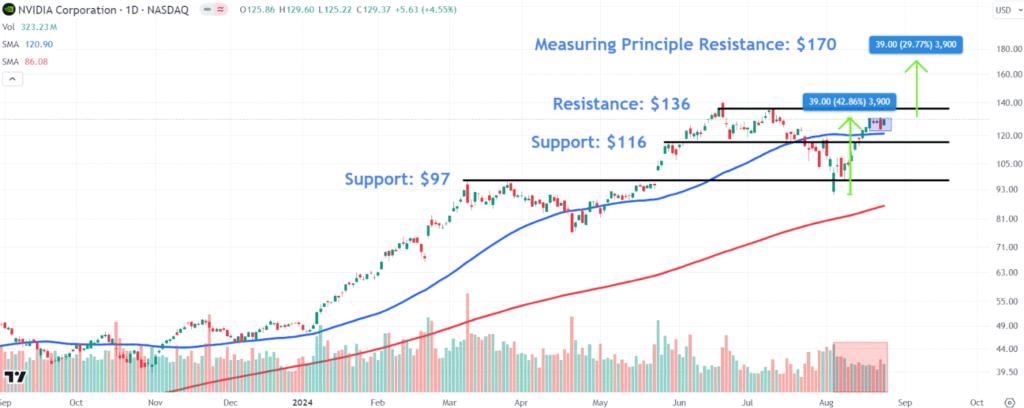

Recent Stock Performance and Market Trends

As of recent years, NVIDIA’s stock has shown resilience despite market volatility. Some notable trends include:

- AI Boom: NVIDIA’s leadership in AI chip development, including its GPUs for machine learning, has positioned it as a key player in the AI revolution.

- Stock Splits: NVIDIA has executed stock splits to make shares more accessible to investors, positively impacting market sentiment.

- Strategic Acquisitions: The company’s acquisitions, such as Mellanox and ARM (proposed but not completed), demonstrate its commitment to expanding market influence.

- Competition and Regulation: Rival companies like AMD and Intel, along with potential antitrust scrutiny, impact investor expectations.

Future Outlook for NVIDIA Stock

Looking ahead, NVIDIA’s growth potential remains strong, particularly in:

- AI and Machine Learning: The company’s continued focus on AI-powered applications could drive long-term revenue growth.

- Data Centers and Cloud Computing: Expansion into enterprise AI, cloud-based services, and data center solutions will likely remain a key revenue driver.

- Metaverse and AR/VR Technologies: NVIDIA’s Omniverse platform and investments in augmented reality (AR) and virtual reality (VR) could open new growth opportunities.

- Automotive and Autonomous Vehicles: NVIDIA’s AI-driven automotive technologies, including self-driving car solutions, are expected to contribute to future expansion.

Conclusion

NVIDIA’s stock price has demonstrated impressive growth and resilience over the years, fueled by innovation, strong market positioning, and increasing demand for AI-driven technologies. While short-term volatility may persist due to economic factors, the company’s long-term outlook remains highly promising. Investors should closely monitor NVIDIA’s earnings, industry trends, and macroeconomic conditions to make informed decisions regarding NVDA stock.

Post Comment